Insurance

Ensure that you’re insured

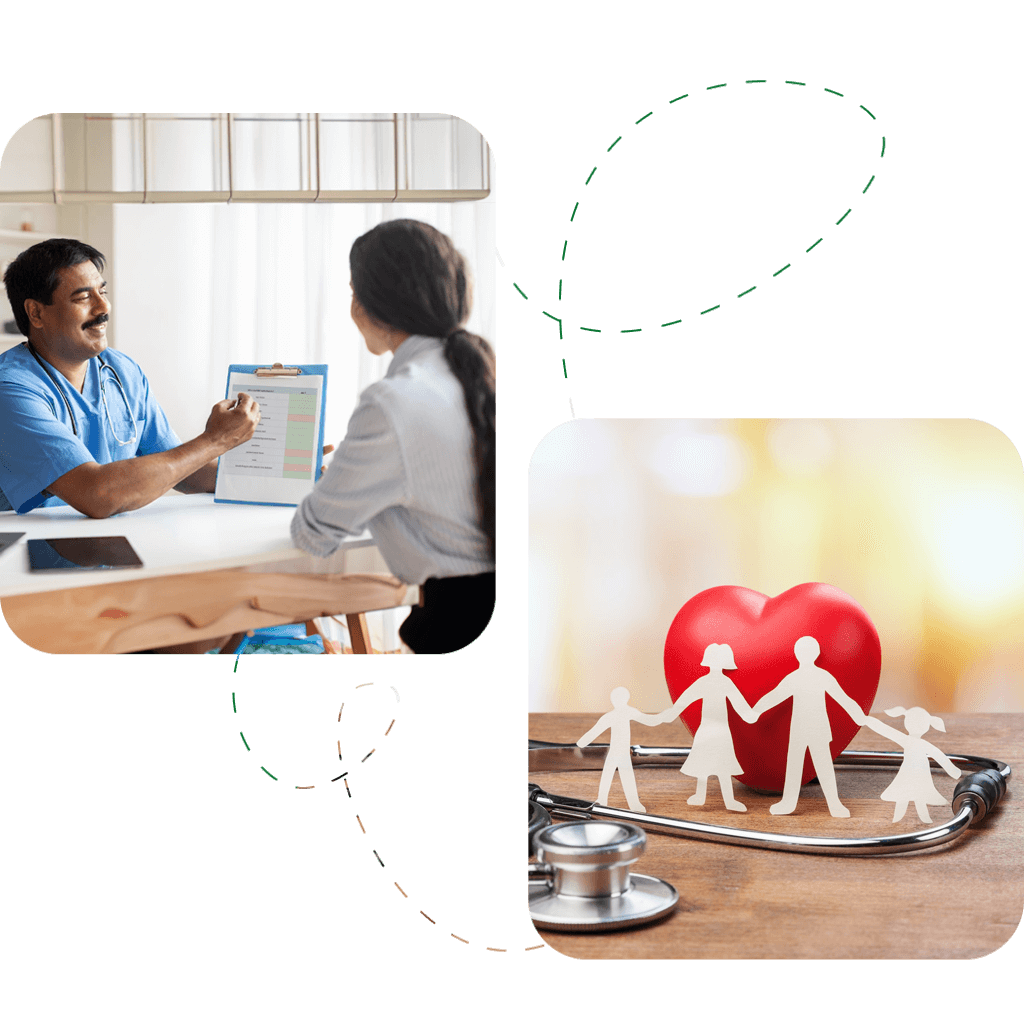

Health Insurance

Why Health Insurance?

You can protect yourself and your family financially in the event of an unexpected serious illness or injury that could be very expensive.

You can have peace of mind in knowing that you are protected from most of these medical costs.

Life Insurance

- Term Life Insurance: Provides a lump sum payout to beneficiaries in case of the policyholder's untimely death.

- Whole Life Insurance: Offers lifelong coverage with a savings component, building cash value over time.

- Endowment Plans: A combination of life insurance and savings, providing a lump sum payout at maturity or in case of death as well as you have the option to avail a regular income payouts along with the lumpsum benefits at maturity.

- Annuity Plans: These plans offer a guaranteed income stream after a certain period or immediately upon investment and this is best suitable for the retirees.

- Unit-Linked Insurance Plans (ULIPs): It invests your premium in various market-linked funds, offering potential higher returns.

Why Life insurance?

General Insurance

General Insurance plans cover any kind of risk other than life-risk of an individual. These plans safeguard your properties from any natural calamities, theft, accidents and so on. The types of general insurance are fire, marine, home, motor insurance, etc.

General Insurance

General Insurance plans cover any kind of risk other than life-risk of an individual. These plans safeguard your properties from any natural calamities, theft, accidents and so on. The types of general insurance are fire, marine, home, motor insurance, etc.

Why General insurance?

To protect your finances from unexpected events like accidents, thefts, or natural disasters.

To ensure you can recover financially if your vehicle is damaged, house is flooded, machineries broken down or belongings stolen.

To ensure that your savings are safeguarded from being wiped out while covering any unforeseen expenses.