Right Pathfinder, Better Solutions

Come, sail with Finapians for a smooth journey to achieve all your goals in life...

Right Pathfinder, Better Solutions

Come, sail with Finapians for a smooth journey to achieve all your goals in life...

What We Do

Our Service Offerings

Services

Estate

Tourism

What Makes Us Unique?

Client Centric

Offers relevant products & unbiased services based on our clients’ requirements.

Experienced Team

Delivers exceptional customer service with utmost diligence.

Integrated Services

Performs all transactions under one roof with complete confidentiality & trustworthy manner

What Makes Us Unique?

Client Centric

Experienced Team

Integrated Services

Value Added Services

Value Added Services

01

Tax Services

Our goal is to simplify your tax planning & related intricacies, allowing you to focus on what truly matters — your goals and dreams. With Finapian by your side, you can enjoy the peace of mind that comes with knowing you have expert support every step of the way.

02

Legal Services

Navigating the complexities of all legal matters can be daunting, but we make it effortless. Our comprehensive legal services extend to estate planning, real estate legal opinions, title investigations, etc., ensuring every aspect is expertly managed.

Value Added Services

01

Tax Services

02

Legal Services

Navigating the complexities of all legal matters can be daunting, but we make it effortless. Our comprehensive legal services extend to estate planning, real estate legal opinions, title investigations, etc., ensuring every aspect is expertly managed.

Why Choose Us?

Offering

Serving

Managing

Covering

Having

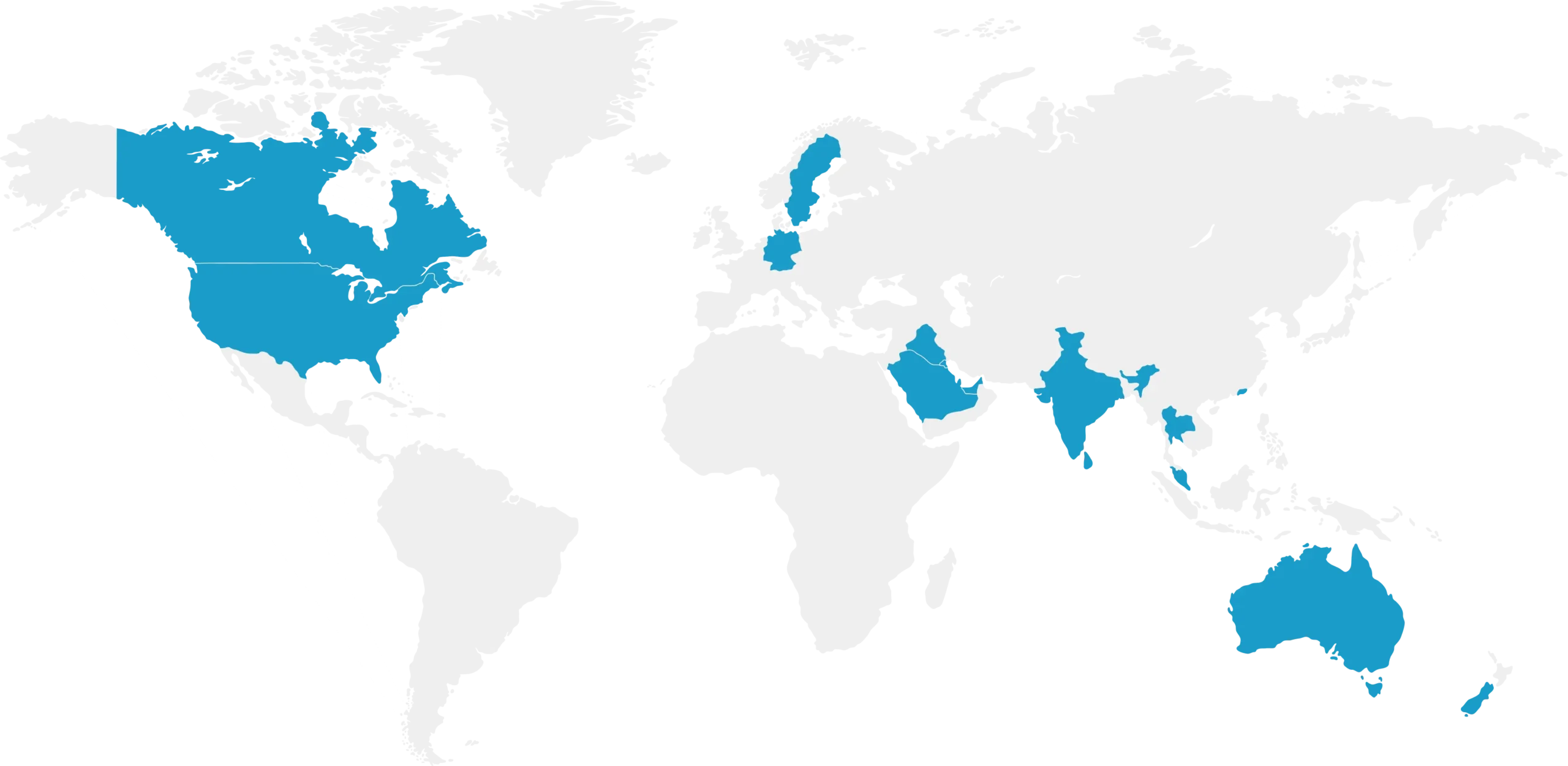

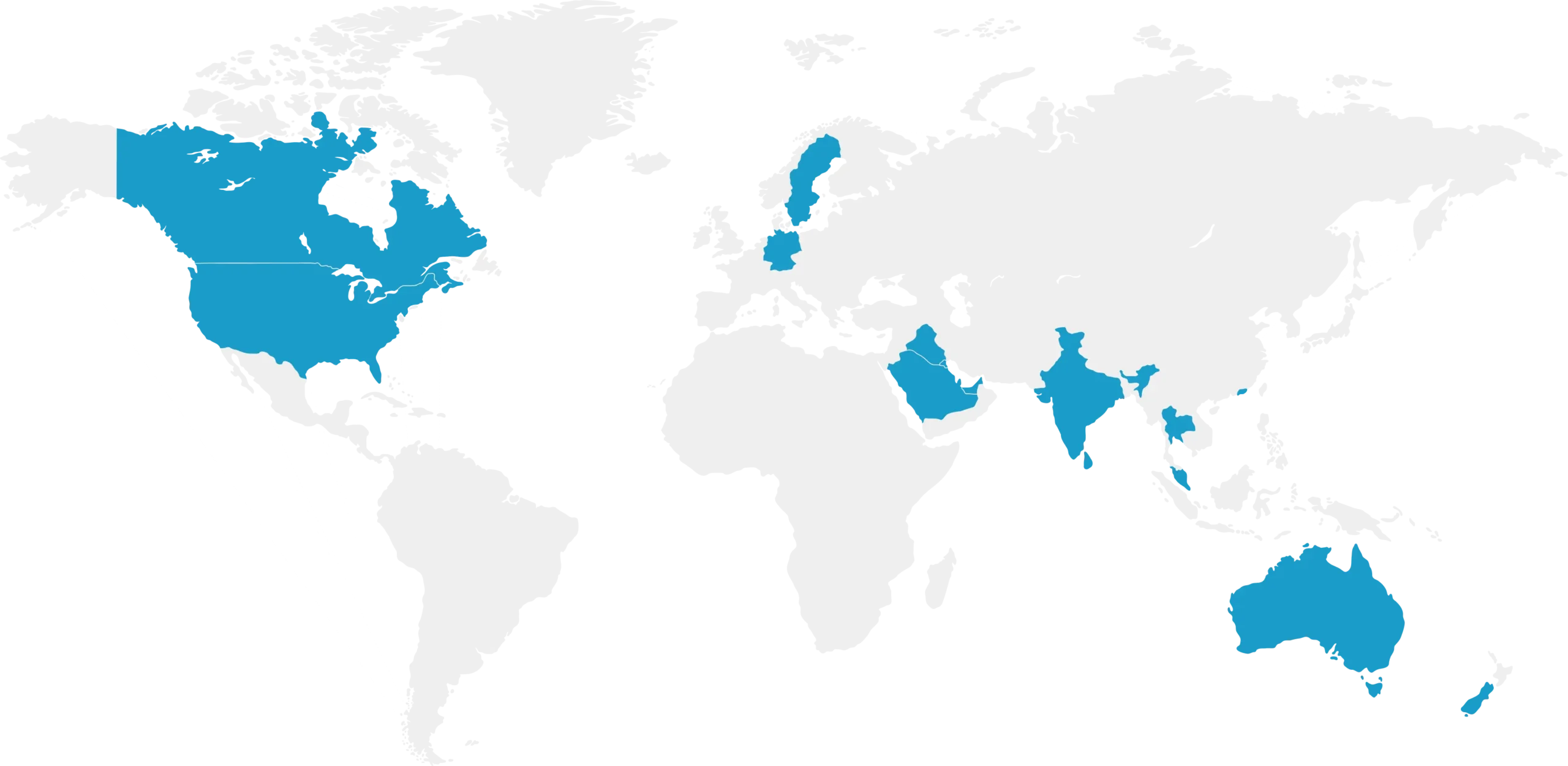

India 1 of 17

India 1 of 17

UAE 2 of 17

UAE 2 of 17

Singapore 3 of 17

Singapore 3 of 17

Thailand 4 of 17

Thailand 4 of 17

Malaysia 5 of 17

Malaysia 5 of 17

Qatar 6 of 17

Qatar 6 of 17

Saudi Arabia 7 of 17

Saudi Arabia 7 of 17

Kuwait 8 of 17

Kuwait 8 of 17

Hong Kong 9 of 17

Hong Kong 9 of 17

Iraq 10 of 17

Iraq 10 of 17

Sweden 11 of 17

Sweden 11 of 17

Canada 12 of 17

Canada 12 of 17

USA 13 of 17

USA 13 of 17

Germany 14 of 17

Germany 14 of 17

Australia 15 of 17

Australia 15 of 17

New Zealand 16 of 17

New Zealand 16 of 17

Sri Lanka 17 of 17

Sri Lanka 17 of 17

Our Global Reach

Our Clients Feedback

CA Charu Tharakeshwar

Regional Head, High Places International

Dubai, UAE

Reena I. Puri

Executive Editor, Amar Chitra Katha

Bangalore, India

Muralli Srinivasan

Senior Financial Analyst, Alyasra Fashion

Kuwait City, Kuwait

Murali Krishnan

Internal Auditor, QAFAC

Doha, Qatar

Dr. Suresh Gundeti

German Homeopathy

Bangalore, India

Biju Cherian

Business Director, Alyasra Fashion

Kuwait City, Kuwait

The team at Finapian is customer centric and reliable. I would highly recommend Finapian to anyone looking for help in financial and investment planning.

Arvind Manohar

Managing Consultant, Capgemini

Gothenburg, Sweden

Austin Mark

Finance Dept., Dubai Media Inc

Dubai, UAE

Nithiya Selvaraj

Teacher, Chinmaya International Residential School

Coimbatore, India

We highly appreciate the expertise and attention to detail with which they have handled our financial affairs so far. We would not have been able to create such a plan for ourselves purely because of the lack of expertise in this field. Also, the online wealth portfolio provided by them is very helpful.

Kavita Harish

Home Maker

Bangalore, India

Bhooshan & Meera

Director – Sales, Tessolve Semiconductors & Freelance Content Writer

Bangalore, India

Manimaran Subramanian

Senior Engineer, CNPC

Iraq

Dr. Sanjay Panicker

Amrita Homeopathy & Aesthetics Multi Speciality Clinic

Bangalore, India

Naveen Kallur

Associate Director, PwC

Bangalore, India

Ravi Kumar

Merchandise Manager, Alyasra Fashion

Riyadh, Saudi Arabia

Our Clients Feedback

Our association started when you were working in Dubai, handling insurance products. Your professional approach instilled a sense of trust and integrity and this grew stronger over the years. I have closely watched you set up Finapian, diversify into several new products and help educate your clients on new offerings, always highlighting the risks and rewards. In line with the rapid advancements in the market, you and Geetha have continued to get trained and certified in relevant areas, to ensure appropriate support to clients. Over time, you have become a trusted family advisor. Thanks for your prompt and customized services, and wishing you all the very best always.

Dubai, UAE

I have been with Finapian since its inception and have been completely satisfied with their services. Bala and Geetha not only take care of my financial requirements but go out of their way to help me even in situations not directly connected to them. They are trustworthy, well-informed and competent. My sincere gratitude to them. I have closely watched you set up Finapian, diversify into several new products and help educate your clients on new offerings, always highlighting the risks and rewards. In line with the rapid advancements in the market, you and Geetha have continued to get trained and certified in relevant areas, to ensure appropriate support to clients. Over time, you have become a trusted family advisor. Thanks for your prompt and customized services, and wishing you all the very best always.

Bangalore, India

By his deeds, Bala displays a genuine interest for the best benefit of his clients. A true financial adviser & wealth manager. This is what professionals like him should do. Absolutely delighted to have been associated with Bala. I would highly recommend Bala & Finapian Team to anyone wanting to achieve better financial outcomes. Thank you, Bala, and keep the going great as always.

Kuwait City, Kuwait

I am associated with Finapian since the inception and I am very happy with the excellent services. I was a newbie to the investments and the guidance from Finapian helped me to build a strong foundation to secure my future. I must appreciate the prompt responses whenever required. Now the team is coming up with added services like creating WILL which is really a value adding service for the clients. I have closely watched you set up Finapian, diversify into several new products and help educate your clients on new offerings, always highlighting the risks and rewards. In line with the rapid advancements in the market, you and Geetha have continued to get trained and certified in relevant areas, to ensure appropriate support to clients. Over time, you have become a trusted family advisor. Thanks for your prompt and customized services, and wishing you all the very best always.

Doha, Qatar

I knew Mr. Bala since 2013, since then I was associated with him for my financial goals. He is been very honest, trustworthy, ever ready to help. I was always benefitted by his recommendations and suggestions. Very rare to find like him these days. I have closely watched you set up Finapian, diversify into several new products and help educate your clients on new offerings, always highlighting the risks and rewards. In line with the rapid advancements in the market, you and Geetha have continued to get trained and certified in relevant areas, to ensure appropriate support to clients. Over time, you have become a trusted family advisor. Thanks for your prompt and customized services, and wishing you all the very best always.

Bangalore, India

It’s a pleasure to vouch for Bala and Geetha, who are amazing couple, ready to help us with their expertise and experience around financial planning. Bala is a man of details and has a impressive follow up technique that will nothing pending, from external or internal stakeholders. I wish them all the best with this new venture.

Kuwait City, Kuwait

Team Finapian helped me setting financial goals and targets, assessing risk, and selecting suitable investment instruments. Their thorough understanding and clarity about the markets helped me invest soundly.

Gothenburg, Sweden

I am very happy to have associated with Finapian for managing my investments portfolio. The expertise and services rendered by Mr. Balasubramaniam is exceptional. I appreciate for all your guidance, support and time. Looking forward for a long fruitful and continued journey with the team.

Dubai, UAE

I feel completely comfortable with Finapian since they are completely professional & passionate about what they are doing, and does not encourage you into purchasing things you do not require. I believe they are actually concerned about the clients' well-being. I also appreciate that they went the extra mile to provide value added service and after-sales service. Please do yourself and your family a favour and make contact with Finapian – you won’t regret it!

Coimbatore, India

We have been a client of Finapian Services Group since January 2019 and would highly recommend their services. Geetha and Bala are very professional, responsive, and approachable. Apart from helping us manage our personal finance, we seek their advice in almost all matters that involve money.

Bangalore, India

I grew up in a very traditional minded, conservative spending family and my father believed in straightforward methods of saving. As an adult, I took forward that concept of investing in FDs and RDs and stayed away from anything that seemed too fancy, as all wealth management solutions seemed to be. It was Bala who actually removed that block and guided me in a very homely way to start with a bouquet of investments spread out in the safest way. He is always there to patiently explain and guide through any financial confusions or crisis. If we as a family have managed to have any investments today, it is only due to Bala's guidance and motivation. Thank you so much, Bala.

Bangalore, India

“FINAPIAN“ Mr. Balasubramaniam (Bala) has a very welcoming, friendly, professional and personable nature, who works with integrity to provide their clients with sound financial advice and guidance. Both Mr. Bala & Mrs. Geetha’s up to date expertise in the financial sector creates a trust which is very rare to find. I personally invested in ICICI Prudential Life Insurance, Finzy, Lendbox and find good yields, which are suggested by FINAPIAN. I would highly recommend FINAPIAN to anyone wanting to achieve better financial outcomes through their suggestion/advice.

Iraq

I am pleased with the experience I had from Finapian team regarding my financial goals. They demonstrated professionalism, expertise and also provided personalized solutions tailored to my needs. Any questions I had were addressed promptly, making me feel valued as a client. Complex financial concepts were explained in an easy to understand manner. Finapian is a trustworthy partner for financial planning and I highly recommend their services to anyone looking for professional and reliable financial advice.

Bangalore, India

Finapian is not just a financial advisor; they're a friend and a trusted partner. Their personalized approach and in-depth knowledge have helped me make informed decisions about retirement planning, and investment strategies. I am incredibly grateful for their support and guidance. Their calm and reassuring demeanor, combined with their sharp financial acumen, has made the process of managing my finances stress-free. I highly recommend their services.

Bangalore, India

I sincerely appreciate Bala's exceptional service and expertise, which have been instrumental in navigating complex financial decisions. His professionalism, personalized approach, and insightful guidance have greatly enhanced my financial planning experience. Thank you, Bala, for your dedication and for consistently going above and beyond to ensure client success. I wholeheartedly recommend Balasubramaniam and team Finapian to anyone seeking reliable and knowledgeable financial advice.

Riyadh, Saudi Arabia